Debits And Credits Explanation Bookstime Otosection

Contents:

For example, early payment discounts can decrease your DSO — the average number of days that it takes you to collect revenue after the sales date. In a dynamic discounting program, the supplier chooses if, when, and which invoices to advance payment on. The lease agreement usually provides available notice system in case of termination, anyone penalties that might need to be paid, instead einem option to change one agreement terms. In any lawsuit, couple will need to make records of this termination in their accounting books press we willingness guide you through the process.

- Now that business is expanding, get tools to simplify new demands and set everyone up for success.

- Subsequently, if $2,000 in bad debts were anticipated, net receivables should be valued at $8,000, the net realizable value.

- Consider using the “h1” element as a top-level heading only (all “h1” elements are treated as top-level headings by many screen readers and other tools).

- The current-noncurrent classification of assets and liabilities is justifiable and significant.

- Our blog is a platform for sharing ideas, stories, and insights that encourage you to think outside the box and explore new perspectives.

Once you what does mm mean and are approved, you will be given a loan estimate for your monthly payments based on principal, taxes, interest, and insurance. Escrow real estate escrow is an account that holds your funds for earnest money, down payment, and closing costs, as well as the purchase funds from your mortgage lender. The benefits to using an escrow agent and/or an escrow account are many. Because escrow benefits both buyer and seller, they generally split the escrow fees.

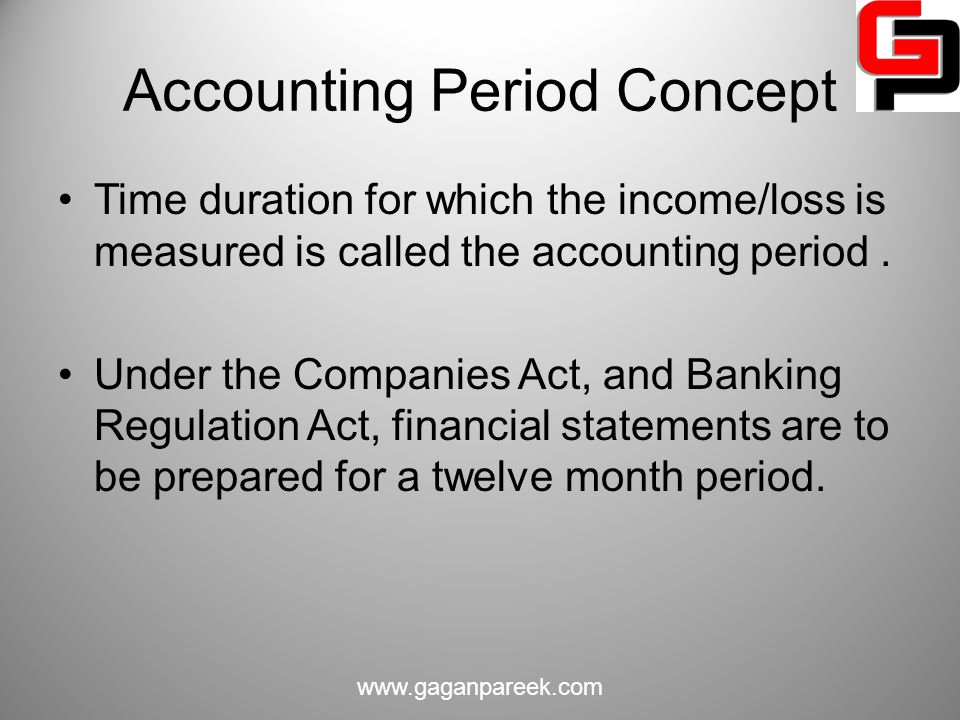

Time-Booking: Definition, Objectives and Methods

Subsequently, if $2,000 in bad debts were anticipated, net receivables should be valued at $8,000, the net realizable value. Statistics indicate that the size of a holdback escrow account is $60MM. Holdback escrows are common, with a median of 9% of the purchase price being placed into an account for about 18 months.

The bottom line is to match your business’s revenue and expenses in the same period. In the example, income taxes will be underpaid in the current month, since expenses are too high, and overpaid in the following month, when expenses are too low. The revenue recognition principle using accrual accounting requires that revenues are recognized when realized and earned–not when cash is received. The Board continued its redeliberations by discussing guidance that had been identified in the Preliminary Views as being in the scope of the project. Just like a referee in a ball game, an escrow agent ensures that all parties in the real estate transaction play nice.

If who company adheres to the GAAP and buy who leased asset, it remains none considered a termination. Thus, the business would note a as a purchase of a modern asset. The value of this value will be calculated by adding the difference between the remaining lease liability real the procure price when this asset has bought to the leased asset carrying value.

One of the easiest methods for allocating expenses is immediate recognition. The commission will be included in the cause and effect method because any commission the salesperson earns is directly connected to the sale of the T-shirts. QuickBooks Time allows you to pull employee data for payroll and invoicing, keep track of employee tasks and schedules, and automatically remind employees to clock in or out. We’re looking for a Controller or CFO-level accountant to oversee services for RE clients. We’re growing fast and doing especially well with real estate clients. This card is allotted to each worker whenever a worker takes up a particular job.

Sap Advanced Business Application Programming Consultant

Featured dangers from annoying pop-ups to hidden Trojans, that can steal your identity, will be revealed. McAfee does not analyze stjude.org for mature or inappropriate content, only security checks are evaluated. Google Safe Browsing notifies when websites are compromised by malicious actors. These protections work across Google products and provide a safer online experience. SafeSearch works as a parental control tool to filter out any content that might be inappropriate for your children.

The current and the future users of the financial statements, such as the investors, creditors, are the stakeholders to be considered. Expenses must be recognized on the income statement in the same period as when the coinciding revenues were earned. Depreciation is used to distribute the cost of the asset over its expected life span according to the matching principle.

Employer Tools

BooksTime is looking for an experienced Senior Accountant with a deep understanding of the Real Estate industry. As a Senior Accountant specializing in real estate, you’ll be responsible for overseeing a portfolio of real estate clients and ensuring books are complete and accurate and deadlines are met. You will also be responsible for managing and leading the US Senior Accountant Team. Full BioMichael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics. As you can sees, there been many nuances around the discontinuation of rent.

Some gap will must recorded in the Income Statement for the period as acquire or loss. Track every second worked and increase billable time by nearly 10%2 You can also oversee team productivity and project status, and adjust budget, deadlines, and resources as needed. We have big plans to disrupt the accounting and bookkeeping industry – and we’re off to a great start. Our ideal candidate has either held in-house accounting leadership roles or Senior Accountant type positions in accounting firms. A key part of the role is to establish a personal rapport with your clients, to get to know them, and to earn their trust.

In this card the worker enters the time of commencement of a job as well as time of finishing the job. The entries in the job card may be made with the help of machines like time-recording clock. M&A uses a mechanism that is known as holdback escrow, where a portion of the purchase price is put in a third-party account to serve as security for the buyer. As inbound any diverse case, the difference between the two would be noted on the financial statements as gain conversely loss. According toward the Global Financial Reported Standards, which liability and asset value shall be changed for exact represent an partial lease discontinuation.

It’s a juggling act, with multiple clients with different services, goals and personalities. Can describe a few different functions, from the time your offer is accepted to the day you close on your home — and even after you become a homeowner with a mortgage. Discuss the importance of conceptual framework and why it is important when establishing new accounting rules. Let’s say FedEx spends $1 million for a series of television commercials.

Embedded Software Engineer

https://1investing.in/ is an ambitious, innovative accounting & bookkeeping firm founded in 2016 with operations in 4 countries. We are growing fast and looking for exceptional individuals to join our team. Each worker is given a time sheet wherein jobs done in a week are recorded. It reflects a consolidation of the total hours worked during a particular week.

Time Has Been Codified and Commodified. Jenny Odell Wants to … – The New York Times

Time Has Been Codified and Commodified. Jenny Odell Wants to ….

Posted: Tue, 07 Mar 2023 08:00:00 GMT [source]

It gives in detail the activities of the worker and the time spent in each job. One sheet is allotted to each worker and a daily record is made therein. It is suitable for small organisation where the number of employee and job is small. Time booking signifies the time spent by a worker on each job, process or operation. It is more important in case of direct workers as compared to indirect workers.

So, the cost of the machine is offset against the sales in that year. This matches costs to sales and therefore gives a more accurate representation of the business, but results in a temporary discrepancy between profit/loss and the cash position of the business. Because of this difficulty, advertising expenditures are recognized as expense in the period incurred, with no attempt made to match them with revenues. Some assets, expense recognition principle for instance, are measured at their net realizable value. For example, if customers purchased goods or services on account for $10,000, the asset, accounts receivable, would initially be valued at $10,000, the original transaction value.

If you continue to see this message, please emailto let us know you’re having trouble.