Cost of Goods Sold Definition, Formula, Calculate COGS

Contents:

When purchasing an inventory item for sales, it’s considered an asset . When selling the inventory item, the asset is reduced and the COGS Account is increased, moving the item from an asset to the COGS section. Once sold, it’s no longer an asset and the cost of the item sold reduces profit and is deducted front the revenue earned to generate Gross Profit.

5G Technologies Global Market Report 2023 – Yahoo Finance

5G Technologies Global Market Report 2023.

Posted: Wed, 19 Apr 2023 11:47:00 GMT [source]

Vikki Velasquez is a researcher and writer who has managed, coordinated, and directed various community and nonprofit organizations. She has conducted in-depth research on social and economic issues and has also revised and edited educational materials for the Greater Richmond area. Financial Intelligence takes you through all the financial statements and financial jargon giving you the confidence to understand what it all means and why it matters.

What Is Included in Cost of Goods Sold?

Conversely, COGS excludes operating expenses – i.e. indirect costs – such as overhead costs, utilities, rent, and marketing expenses. And variable costs, but it is almost always predominantly variable. Fortunately, Profit Frog simplifies COGS calculations for owners of small businesses.

Doing this would overstate margin and overstate overhead expenses. That is how you calculate both the cost of revenue for a service company, the cost of goods for a service company, and gross profit for a service based business. Once you’ve determined your COGS, then you can figure out how to reduce your cost of goods sold. Direct Labor – Direct labor should be included in the cost of revenue for a service company. Let’s say you own a junk removal business, and you get a job to clean up an old building.

Xero does not provide accounting, tax, business or legal advice. When you buy in more goods than you sell, it may look as though you have made a loss and have no tax to pay. But there’s a further adjustment to make in your accounts to reflect that you still own some of the items. In a standard manufacturing or distribution company, this is about the same as the cost of the goods sold. In a services company, this is more likely to be personnel costs for people delivering the service, or subcontracting costs. Many of the expenses that are classified as COGS are billed together with operating expenses.

COGS vs. Assets vs. Expenses

Ending Inventory is the value of what remains at the end of the accounting period. In the case of a manufacturer, Inventory includes the cost of raw materials, labor to produce the item, and sometimes additional allocations of other related costs. Manufacturing businesses must also calculate yield, something most other businesses don’t. For example, buying a sheet of steel might cost $130 dollars and make 3 widgets.

There are also some cases that businesses, specifically service companies, do not have COGS and inventories, thus, no COGS are displayed on their respective income statements. So, each time the company does an air conditioner repair job, they incur $850 of hard costs, generate a gross profit of $450, and have a gross profit margin of 34%. On the other hand, Hot Spot HVAC Services is an HVAC company that installs and repairs air conditioners and furnaces. The company writes off many incidental materials and supplies, such as coils, ducts, and vents. Examples of pure service companies include accounting firms, law offices, real estate appraisers, business consultants, professional dancers, etc.

Value added tax is generally not treated as part of cost of goods sold if it may be used as an input credit or is otherwise recoverable from the taxing authority. Cash discounts – may reduce COGS, or may be treated separately as gross income. Cost of goods sold is the carrying value of goods sold during a particular period.

Cost of Goods Sold FAQs

If your business does COGS calculations annually, then the beginning inventory of every year should be the same as last year’s ending inventory. Note that the direct cost of manufacturing one packet is $2.00, and below are the other statistics. Learn all you need to know about Cost of Goods Sold, one of the most important metric businesses have to report in the Profit and Loss statement. Let’s look closer at how we calculate cost of goods sold and how you can use it to manage your business. While this COGS primer is for a basic understanding, COGS implementation will vary from business to business.

- For instance, if your COGS are higher in winter, you can diversify your business with products in demand in winter to minimize the risk of making losses.

- You divide the total cost of items in inventory by the number of units available to get the weighted average cost.

- So far, this discussion of COGS has focused on GAAP requirements, but COGS also plays a role in tax accounting.

- Keep in mind that the costs accrued in producing products that remain unsold at the end of a given accounting period are also excluded from COGS.

You need to be able to log into the system to run payroll in order to receive the service you’ve paid for. Therefore, the cost of that company’s hosting provider for their production environment is a Cost of Goods Sold. The cost of goods sold is the cost of bringing all sold products to customers, including sourcing raw materials, delivery, distributor fees, etc. In accounting terms, it is a simple equation, once you have all the data in place. Examples of pure service businesses include accounting, legal, real estate appraisers, business advisors, professional dancers, etc. All of these sectors do not publish COGS despite the fact that they incur costs regularly to supply their services and have business expenditures.

LIFO

These costs are known as Cost of Goods Sold , a calculation that usually appears in a business’s Profit and Loss statement (P&L). Cost of Goods Sold are expenditures in the course of business directly related to the production of revenue. COGS are also referred to as the “Cost of Revenue” or “Cost of Sales.” In a nutshell, COGS tracks how much a business is spending to generate their top line sales. COGS differ from overhead expenses in their direct connection to the production of revenue, while overhead expenses are related to the operation of the business as a whole. Cost of revenue refers to costs paid for contract services, such as labor services or sales commissions. In order for these costs of revenue to count as COGS, the IRS dictates that services rendered must produce a physical product that is sold.

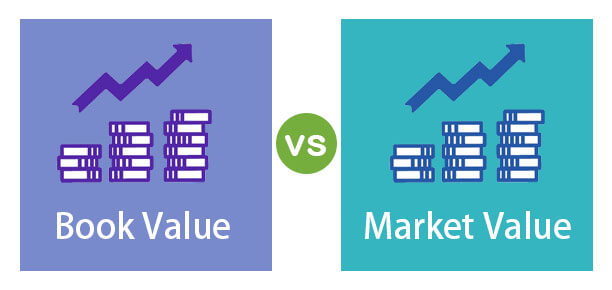

He sells parts for $80 that he bought for $30, and has $70 worth of parts left. If he keeps track of inventory, his profit in 2008 is $50, and his profit in 2009 is $110, or $160 in total. If he deducted all the costs in 2008, he would have a loss of $20 in 2008 and a profit of $180 in 2009.

Gross profit is a key profitability figure for a small business. It’s calculated by subtracting cost of goods sold from sales revenue. Here’s how you can use gross profit, and the gross profit margin, to measure your business’ production efficiency. COGS is sometimes referred to as cost of merchandise sold or cost of sales. Some companies that sell a mix of products and services prefer a broader term, cost of revenue, of which COGS is one component.

4G Services Global Market Report 2023 – GlobeNewswire

4G Services Global Market Report 2023.

Posted: Wed, 19 Apr 2023 11:57:01 GMT [source]

Once you have determined which expenses to include in the cost of revenue for a service company, you should come up with your cost of revenue per unit. Cost of Goods Sold per unit and Cost of Revenue per unit is the model we use with our ProjectionHub application. Shipping Costs – Let’s say you own an accounting firm that audits companies.

Know to differentiate between the two since you need to ignore indirect costs in your calculations. Salaries, rent paid on the building used to carry out the business’s manufacturing activities, or even the depreciating value of tools used in the production process are all indirect costs. Businesses need to track all direct costs of processing goods for sale, including labor and material expenses.

- If he deducted all the costs in 2008, he would have a loss of $20 in 2008 and a profit of $180 in 2009.

- To find the sweet spot when it comes to pricing, use your cost of goods sold.

- In a periodic inventory system, the cost of goods sold is calculated as beginning inventory + purchases – ending inventory.

- Purchases are usually the costs incurred during the reporting period, while ending inventory is the value left at the end of the reporting period.

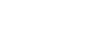

Cost of revenue is most often used by service businesses, although some manufacturers and retailers use it as well. Similar to COGS, cost of revenue excludes any indirect costs, such as manager salaries, that are not attributed to a sale. LIFO inventory valuation is a reverse-production-order approach.

For businesses with under $25 million in gross receipts ($26 million for 2020), there are some exceptions to the rules for inventory, accrual accounting and, by extension, COGS. So far, this discussion of COGS has focused on GAAP requirements, but COGS also plays a role in tax accounting. Businesses that hold physical inventory—such as manufacturers, retailers and distributors—are required to calculate COGS when determining their taxable income.

The cost of goods accounting equation is presented immediately after the revenue line items in the income statement, after which operating expenses are presented. Cost of Goods Sold represents all costs involved in producing goods that a company sells over a certain period of time. The cost of goods sold, also known as the cost of services or the cost of sales, includes both the cost of materials used to create the goods, and the cost of direct labor .

Indirect ExpensesIndirect expenses are the general costs incurred for running business operations and management in any enterprise. In simple terms, when you want to buy grocery from a supermarket, the transportation cost to get you to the supermarket and back is the indirect expenses. Typical items included in the costs of sales are purchases but also direct labour, delivery and storage costs. The gross profit can then be used to calculate the net income, which is the amount a business earns after subtracting all expenses. For a consulting company, for example, the cost of sales would be the compensation paid to the consultants plus costs of research, photocopying, and production of reports and presentations. For software companies, the cost of goods sold will represent all the expenses required to bring software to the customer.