Dividends: Definition, Types of Dividends

Content

The cash dividend refers to the distribution of the cash to the shareholders as a return on their investment. The dividend is the return on the investment that investors receive from shares that they purchased. The dividend is normally declared and distributed annually. A stock split refers to a situation where a company decides to split each share into multiple shares. A 3-for-1 stock split means each old stock is split into 3 new stocks.

However, it does lower the Equity Value of the business by the value of the dividend that’s paid out. Common – this refers to the class of shareholders (i.e., common shareholders), not what’s actually being received as payment. Below is an example from General Electric’s ’s 2017 financial statements. As you can see in the screenshot, GE declared a dividend per common share of $0.84 in 2017, $0.93 in 2016, and $0.92 in 2015. A dividend’s value is determined on a per-share basis and is to be paid equally to all shareholders of the same class. Investing in the stock market can be a great way to build long-term wealth.

Types of Dividend

They can serve as both an additional source of income in the short-term and as a way for investors to grow their portfolios over time. A company Marini Incorporation declared a liquidating dividend of $2,500,000 on January 1st, 2020. A company may not have sufficient funds to issue dividends in the near future, so instead it issues a scrip dividend, which is essentially a promissory note to pay shareholders at a later date. When dividends https://online-accounting.net/ are distributed, they are stated as a per share amount and are paid only on fully issued shares. Treasury stock is stock that is held by the company that issued the stock. Typically, treasury stock is considered “issued” – i.e., it has been placed in the market – but not “outstanding” because a shareholder does not own it currently. Companies are not allowed to vote their own treasury stock nor does the treasury stock receive a dividend.

The primary tax liability is that of the shareholder, though a tax obligation may also be imposed on the corporation in the form of a withholding tax. In some cases the withholding tax may be the extent of the tax liability in relation to the dividend. A dividend tax is in addition to any tax imposed directly on the corporation on its profits.

Types Of Dividends: Stock Dividends

The answer is to receive some sort of distribution from the company during the course of the company’s lifetime. That term, “distribution,” and its cousin, “dividend”, are terms that we have used several times before in this class. However, we are now going to take a look at what they mean and how they operate in a business context.

How to Create Retirement Income That’s Driven by Cash Flow – Kiplinger’s Personal Finance

How to Create Retirement Income That’s Driven by Cash Flow.

Posted: Mon, 30 Jan 2023 10:30:05 GMT [source]

These rules are set to expire in 2013, when dividends will be taxed as ordinary income (i.e., at the recipient’s ordinary income tax rate). For companies, there are several reasons to consider sharing some of their earnings with shareholders in the form of dividends.

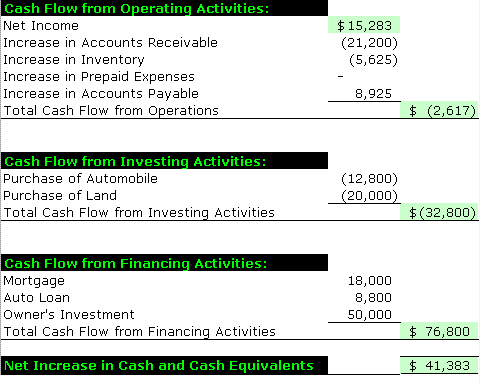

How to Buy Dividend-Paying Investments

The dividend received by a shareholder is income of the shareholder and may be subject to income tax . The tax treatment of this income varies considerably between jurisdictions. The corporation does not receive a tax deduction for the dividends it pays. The third type of dividend is property dividend; in this type of dividend Types of dividends distribution, the Company distributes some property among shareholders as a return on their investment. The dividend payment increases the shareholders’ confidence in the business’s financial performance. So, the net impact of the cash dividend payment is the decrease in the cash and the decrease in retained earnings.

On the date of declaration, the board of directors resolves to pay a certain dividend amount in cash to those investors holding the company’s stock on a specific date. In addition, companies can also issue special one-off dividends. The company American Financial Group , for example, has paid 15 special dividends in 10 years in addition to its regular dividend payments. These dividends pay out on all shares of a company’s common stock, but don’t recur like regular dividends. A company often issues a special dividend to distribute profits that have accumulated over several years and for which it has no immediate need. A high-value dividend declaration can indicate that the company is doing well and has generated good profits. But it can also indicate that the company does not have suitable projects to generate better returns in the future.